Finding Healthcare on the Road | Stride Health

Intuitive Heath Coverage For Freelancers & People On The Road

Sponsored by Stride Health

Review & Photos by Gale Straub, She Explores

Health insurance is one of those sticky road-life items that doesn’t really get talked about. It’s easy to ask someone how they shower or cook their meals, but healthcare is personal. It is integral to our well being, required in the United States (unless you want to pay a significant tax penalty), tedious to acquire, and it is expensive. With all the peaceful images of life on the road and awesome build outs in progress, it’s easy to overlook healthcare. It’s certainly not glamorous, but it is essential.

Here’s my story:

When I quit my full time job, I looked into COBRA as an option for continuing my high deductible plan. I was amazed to find that my bare bones plan cost over $400 a month. On top of that, I would need to pay full price in the off-chance I went to the doctor, unless it was for preventative care. A high deductible plan is typically advised for young people without prescriptions or ongoing issues, but it means paying a lot out of pocket when you do visit.

All of a sudden, I needed to learn about healthcare. A $400+ monthly charge wasn’t sustainable with my savings plan. I turned to Healthcare.gov and the (figurative) headaches began. My frustration would last for the next 18 months. The government run system is new and prone to bugs. It is most ideal for people with low paying jobs that do not provide insurance. It would be an understatement to say that it is not ideal for travelers, freelancers, or people starting their own business. Why? Because it’s not the norm. I called Healthcare.gov when I was looking for the right insurance multiple times. Rather than answering questions like: “Do you offer a plan that is accessible nationwide?” and “My previous year tax return is not going to be accurate for this year’s income, what is the best way to update that information?”, the representatives rattled off responses that did not relate to my situation.

Sure, I ended up getting an OK plan, but I felt uneducated and frustrated. I paid out of pocket in several states and my boyfriend and I even lost coverage at one point due to a system glitch.

There’s a better option:

When I got off the road, I learned about Stride Health and I knew that it would be my platform choice to purchase health care in 2016. It’s an intuitive, streamlined website that was made with travelers, creatives, and freelancers in mind. It’s a lot like having a health care coach, both during signup and after enrollment. The biggest surprise is that the platform is free to use and doesn’t change the cost of your healthcare.

When you get sick & you’re stuck in your vehicle, you don’t want to think about finding a doctor. Photo by Jon Gaffney.

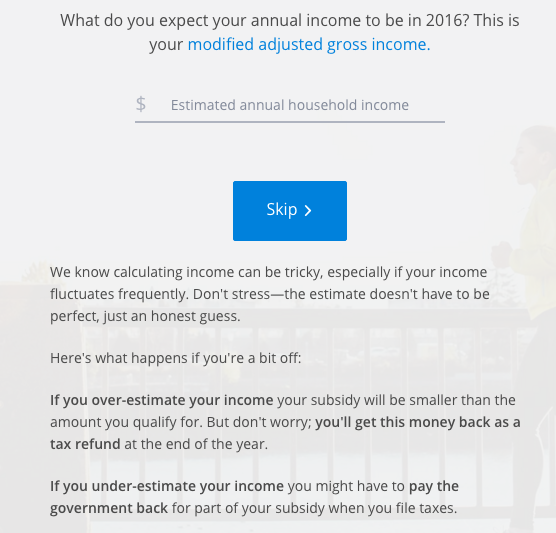

It’s open enrollment right now, so I went to the Stride website anticipating the old headache to return. I noticed the straightforward but conversational tone right away – Stride asks you simple questions to determine which coverage is right for you. The company understands that it can be difficult to estimate income when it varies month by month, and it was refreshing to read.

An example of the conversational tone of the platform

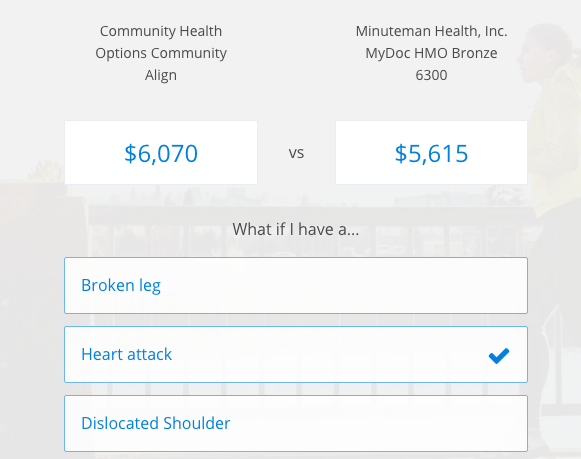

Stride also asks simple questions to estimate your medical costs for the year, such as whether you take prescription drugs daily or have medical conditions which necessitate frequent health care. Based on your answers, you’re provided with a recommended plan and price, net of any government subsidies you are eligible to receive. You can then compare the plan with other plans to pick the best one for you.

I had a bit of fun using the scenario tool to compare plans. When you’re relatively healthy, it’s good to keep in mind what a more catastrophic event might cost.

Ultimately, Stride recommends the plan for you based on total anticipated out of pocket costs for the year, but you can use the tool to compare maximum costs if that is a concern. Of all the plans available to you, each is ranked so you can take a look at other plans that might suit your needs better. The breakdown of each and every plan is available including copays, prescription costs, and special coverage. There is also a tool that allows you to search for plan doctors in your area.

Based on my number 1 ranked plan, I had the opportunity to save over $100 a month compared to the insurance I chose in 2015 through Healthcare.gov. While this is in part because I decided on an HMO over a PPO (I’m a little less all over the place now), it’s also because the Stride algorithm works so well. With all the information in front of you, it’s easy to make the best and most educated decision. I wasn’t surprised to see right on the website that people save on average $418 per year on insurance.

Once you’re ready to apply for your plan, Stride walks you through the government subsidy portion (if applicable) and readjusts your cost based on those answers. I had some questions when it came to this section and reached out for help via email. I was surprised (and pleased) to receive a prompt response from a real human being! In contrast, Healthcare.gov sends form messages in pdfs that you have to log into Healthcare.gov to read. For a “real time” response, I had to call and experience the wait times.

When you are ready to apply, you enter account information for the first premium payment. Stride Health handles the rest and will be in touch with follow up information. They also become your personal spokespeople and concierge team from that moment on. Got a problem with your health insurance company or a question about coverage? You can contact Stride and they’ll get it straightened out for you.

I can’t express how much time Stride would have saved my boyfriend, Jon, and myself on the road. For example, we were hanging in Yosemite National Park when Jon came down with an atrocious case of poison oak. It wasn’t an emergency and the health services at Yosemite didn’t take Jon’s insurance, so we ended up leaving the park and heading back to the Bay Area to find a dermatologist. It would have been great to be able to call Stride to find the closest option. Similarly, in Oregon I paid out of pocket at an urgent care because I was sick and uncomfortable – I just wanted to get back to my campsite. The concierge team would have helped me make the best decision for the area I was in.

I could go on with my “woulda coulda shoulda’s” but instead, I’ll pay it forward and hope that you, the reader, end up choosing a great plan that fits your lifestyle.

Healthcare tips for travelers and freelancers:

- Consider a PPO if you are on the road in the United States, it’ll be easier to see a doctor

- Weigh whether you can pay more in monthly premiums or a larger amount if an emergency occurs

- High deductible plans mean lower monthly premiums but high out of pocket costs for treatment

- Don’t get frustrated when you do have to pay money at the doctor. It’s important to take care of yourself.

- Track your income and expenses as closely as possible. Whether you use Stride Health or Healthcare.gov, you’ll need to provide proof of income to receive government subsidies.

- Stash away a little bit of money each month for an emergency fund. That way if something happens, you won’t eat into your monthly expenses.

Be the first to comment