Saving for a Big Life Change

Saving For A Big Life Change

Like a road trip, or, well, anything!

Photos & Text by Gale Straub, She-Explores

A common question that I get about long term travel and big adventures is how to make money en route. But what about saving up money beforehand? If your travels have a finite length, or you’d like a cushion for flexibility – taking the time upfront to save can help round out your experiences and minimize stress on the road.

I was an accountant before I quit my job in May of 2014 and I was very methodical about saving money in a way that didn’t feel overly restrictive. Money-rexia is real, and it’s not fun.

I saved for 15 months using the following method; Access this workbook and follow along! [Note: the $’s in the spreadsheet don’t reflect my own income or expenses, though they do reflect my childless, carless, mortgage-less life. I know that everyone’s financial situation is different. They are just examples that I hope will be helpful to replace and fill in for yourself. Just save a copy and you’re good to go!]

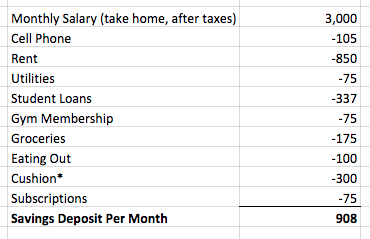

1. Figure out a realistic minimum amount you can save each month.

Start with your monthly take home salary, then back out all your fixed and variable expenses.

Start with your monthly take home salary, then back out all your fixed and variable expenses.

Fixed: The same amount each month, e.g. rent.

Variable: Estimated because while expected, they change each month. Always estimate on the higher rather than lower side.

Cushion: These are random expenses (entertainment, emergency etc) that you don’t expect but you should budget for in order to estimate a conservative monthly savings deposit.

This is a good time to look through your checking account and credit card bill to determine if there are any fixed expenses you can easily cut out. For example, cancel a Hulu/Netflix account that you no longer use, or swap out cable. Do you really watch 100’s of channels?

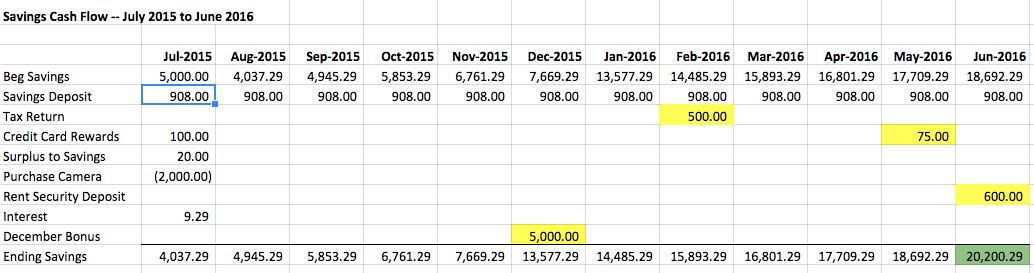

2. Project (and track) your savings.

Once you’ve calculated a realistic amount you can save each month, open a separate savings account that is difficult to draw from. I used CapitalOne 360 because it earns a tiny bit of interest.

Track your savings using the spreadsheet in tab 2. Because this only relates to savings, it should not include those everyday fixed or variable expenses. The example below shows “Purchase camera” because the money used to purchase it was taken out of savings. You may end up purchasing a plane ticket, or putting a down payment on a recreational vehicle and using your savings account to do so.

Start by entering the savings you currently have under the start date (Jul-2015). If you have $0, that’s ok – just enter $0.

The savings deposit you calculated in Tab 1 will automatically pull. This should be an easily savable amount each month, so you can plan for it. If for some reason you are unable to save that amount one month, just change it and make sure to correct the cell formulas.

You may have certain amounts you know you will receive in the future (e.g. tax return, rent security deposit, bonus from work), but you aren’t sure how much. Enter a conservative amount under the month you will receive and highlight it in yellow. When you receive the amount, adjust for what you actually deposited, and unhighlight the cell. This way you will still be able to estimate your final savings.

The “Surplus to Savings” amount is whatever extra you can deposit to your savings account each month, after all your expenses have been paid. It may not be much, but every little bit helps! It also feels good to make an extra deposit toward your goal.

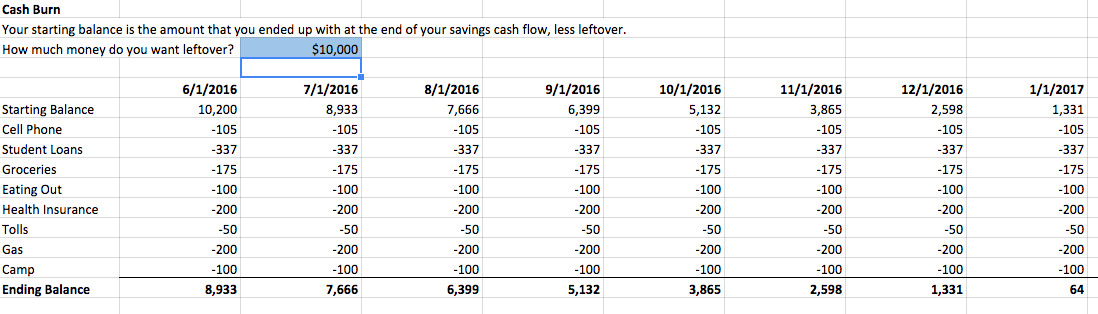

3. Estimate how long your savings might last with a cash burn spreadsheet.

Your “Starting Balance” is the amount of money you saved, less the amount you want to still have at the end of your travels. In the example, we saved a total of $20,200 and want to have $10,000 leftover when all is said and done. This gives us $10,200 to allocate towards expenses on the road.

Estimate fixed and variable expenses. Be generous with the variable expenses like eating out, groceries and gasoline. Think about additional expenses that aren’t listed here, including health care costs, prescriptions, hotels, film, and break downs. This is why it’s good to have a nice “leftover” buffer.

The example provides 6 months of cash to burn:

Play around with the three tabs of the spreadsheet to figure out a plan that works for you. I know that each person has a different relationship with money and financial situation. I know that income ebbs and flows for most. I hope that what was helpful for me, may translate in some way to bring you one step closer to whatever life change you dream up.

Be the first to comment